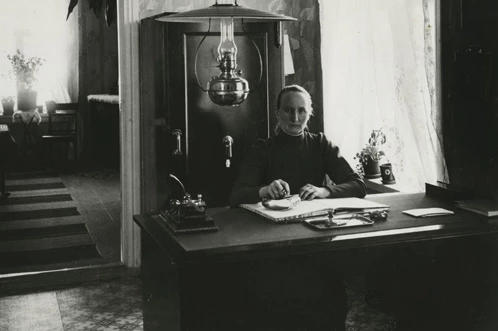

Roots dating back to 1820

Our family tree of around 300 banks includes some of the oldest banks in the Nordic region. These banks were pioneers in the establishment of a commercial banking industry.

Sparekassen for Kjøbenhavn og Omegn

Denmark 1820

Wermlandsbanken

Sweden 1832

Christiania Kreditkasse

Norway 1848

Föreningsbanken i Finland / Suomen Yhdyspankki

Finland 1862